Compounded semiannually formula

In this question we need to compute the effective annual rate EAR. He is going to receive 3 semi-annual compound interest.

Compound Interest Calculator Daily Monthly Yearly

This lets us find the most appropriate writer for any type of assignment.

. An investment of 100 pays 750 percent compounded quarterly. SOLUTION Here the initial balance is 1000 and i 1 01. The detailed explanation of the arguments can be found in the Excel FV function tutorial.

PMT 100 semiannually starts at the end of the first 6 months What is the PV. Lets consider that an individual deposits initially 100000 and that he makes at the end of each year an additional contribution of 5000 over the next 20 years. See how much you can save in 5 10 15 25 etc.

Calculate the future value of money using the formula. Company XYZ issued bonds worth of 5 million having a 10 coupon rate and maturing in 10 years. First change the interest rate to decimal- 3100 003.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The following formula can be use d for calculating the effective rate. A bank CD that pays 711 percent compounded semiannually.

If the interest is compounded Quarterly. Let B 1 be the balance at the end of the first interest period and B 2 be the balance at the end of the second interest period. R 05 5 percent expressed as a decimal.

Calculate the effective annual interest Calculate the effective annual interest A. Examples Use the EFFECT Worksheet Function. Ods for a deposit of 1000 at 2 interest compounded semiannually.

The money is left in the account for two years for example. Compounded semiannually g4 annually PMT 100 annually start at the end of the first year. In this case this calculator automatically ajusts the compounding period to 112.

Using the formula above depositors can apply that daily interest rate to calculate the following total account value after two years. Continuous compounding is the mathematical limit that compound interest can reach. The present value formula for a single amount is.

Assume that the 1000 in the savings account in the previous example includes a rate of 6 interest compounded daily. 6000 in an investment for five years. At the end of this period you extended the loan for 3 years without the interest being paid but the new interest is 10 compounded semi-annually.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. PV of Constant annuity. To use the general equation to return the compounded interest rate use the following equation.

Thought to have. Lets use the following formula to compute the present value of the maturity amount only of the bond described above. The formula you would use to calculate the total interest if it is compounded is P1in-1.

A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. The company has set up sinking up to pay off the bond. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan.

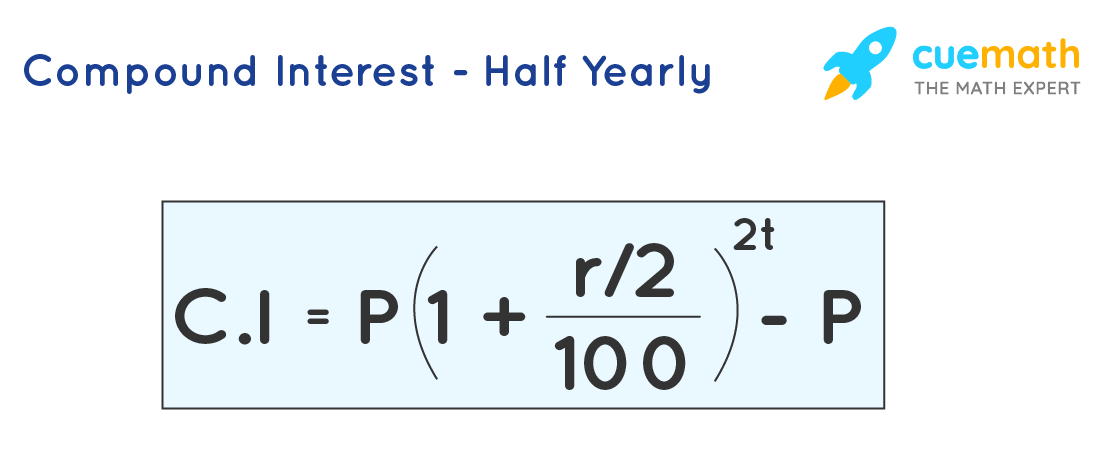

The formula to calculate compound interest is-P1in-1 Here is an example of how interest is compounded semi-annually-A person invests Rs. 18 with Semiannually compounding frequency. A t 365 2 A t.

Determine the number of compounding terms. 5000 PMT 1 6 1-11610 PMT 1 67934 2. Include additions contributions to the initial deposit or investment for a more detailed calculation.

In this example since the interest is compounded annually there is one compounding period. What interestreturn rate should an investment generate in order to reach certain future value. Years at a given interest.

Coupons are to be paid semiannually and the market interest rate says 6. In economics and finance present value PV also known as present discounted value is the value of an expected income stream determined as of the date of valuationThe present value is usually less than the future value because money has interest-earning potential a characteristic referred to as the time value of money except during times of zero- or negative interest rates. The maturity amount which occurs at the end of the 10th six-month period is represented by FV The present value of 67600 tells us that an investor requiring an 8 per year return compounded semiannually would be willing to invest 67600 in return for.

This calculator accepts the folowing intervals. This lets us find the most appropriate writer for any type of assignment. Enter the email address you signed up with and well email you a reset link.

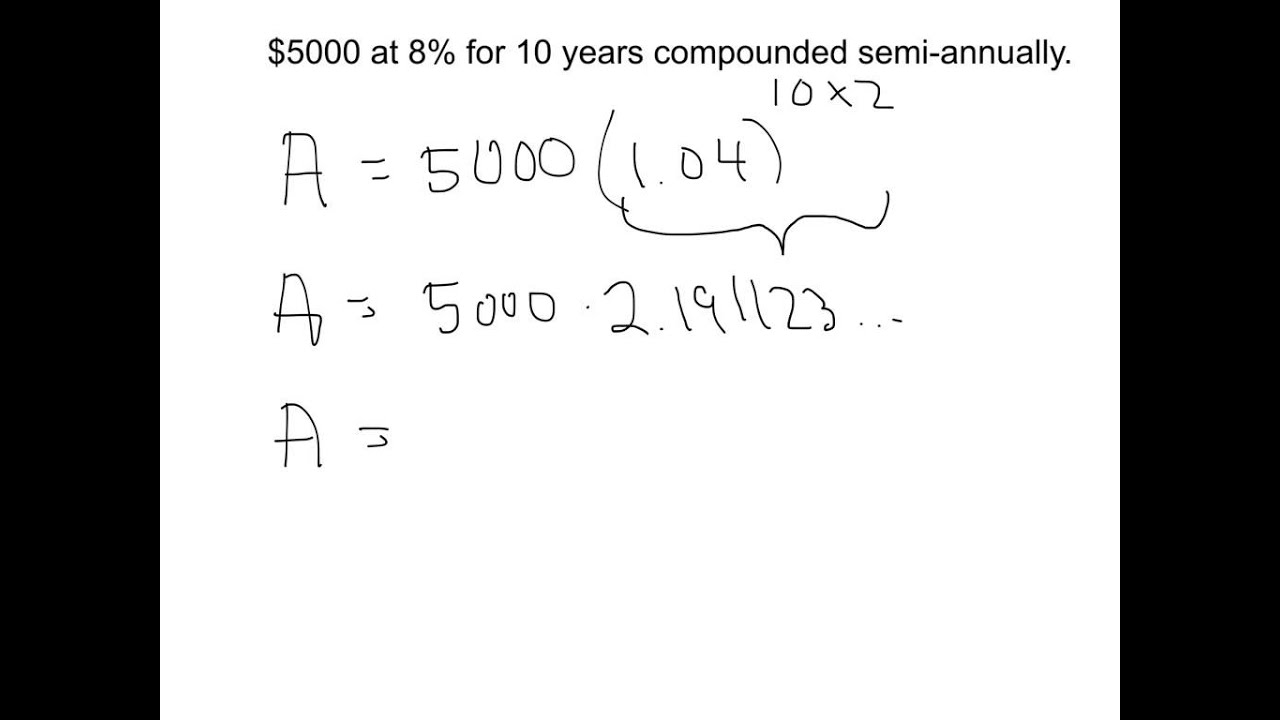

Determine how much your money can grow using the power of compound interest. In the equation P 5000. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate.

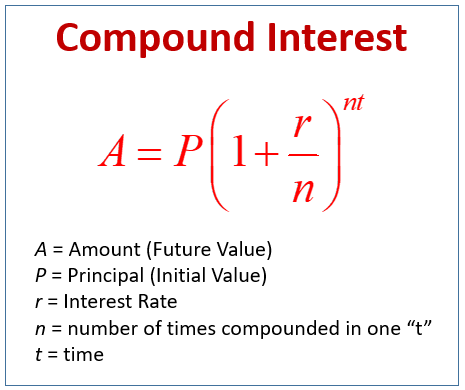

The interest can be compounded annually semiannually quarterly monthly or daily. The answer 8573 tells us that receiving 100 in two years is the same as receiving 8573 today if the time value of money is 8 per year compounded annually. If for example the interest is compounded monthly you should select the correspondind option.

The following formula returns the compounded interest rate. Similarly applying formula 1. Calculation Using the PV Formula.

This amounts to a daily interest rate of. It is an extreme case of compounding since most interest is compounded on a monthly quarterly or semiannual. In general the interest rate for the compounding interval annual rate number of compounding periods in one year.

How to calculate interest compounded semiannually. In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

Suppose you invested 5000 in an account that paid 5 percent interest compounded annually for eight years. By formula 1 B 1 1 011000 101 1000 1010. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate.

According to the formula. Using the second version of the formula the solution is. PV 1 PMT 1 r 1.

Here are the steps to solving the compound interest formula. The formula for compounded interest is based on the principal P the nominal interest rate i and the number of compounding periods. Today is the same concept as time.

Sinking Fund Formula Example 2.

Present Value Frequency Of Compounding Accountingcoach

Mathematics Of Compounding Accountingcoach

Compounding Interest Formulas Calculations Examples Video Lesson Transcript Study Com

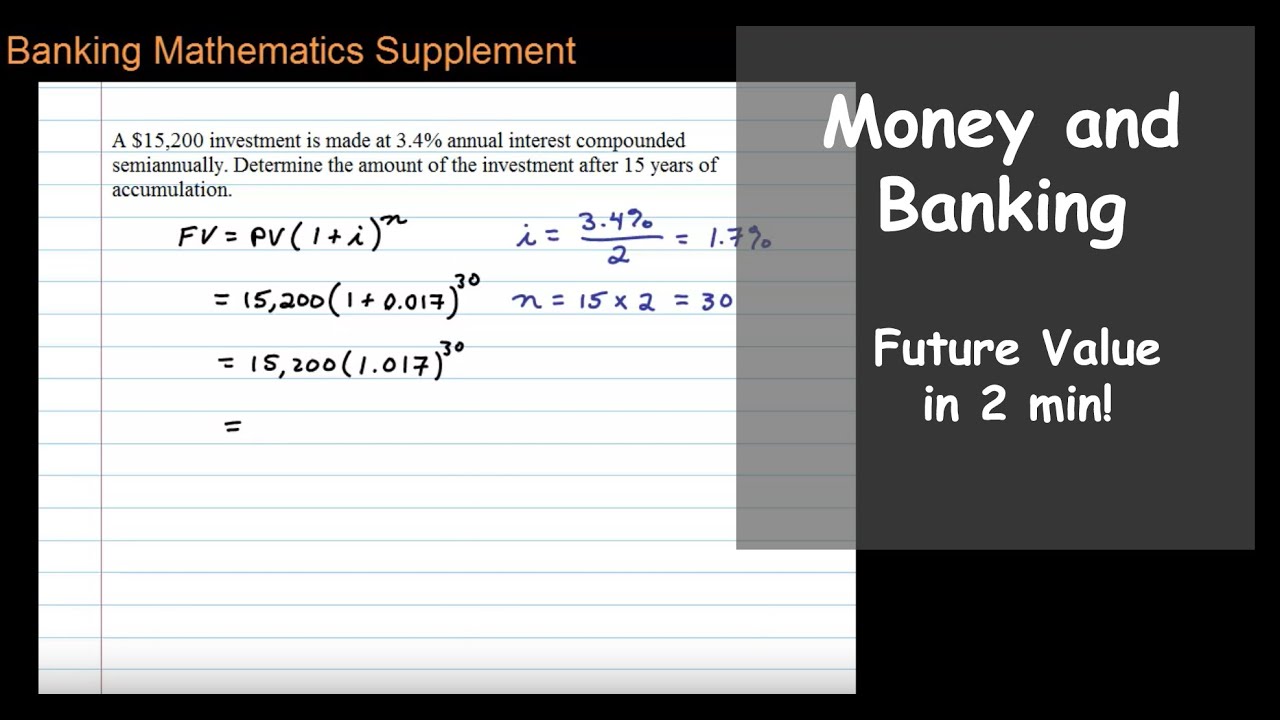

Future Value With Interest Compounded Semiannually Youtube

Word Problems Compound Interest Video Lessons Examples And Solutions

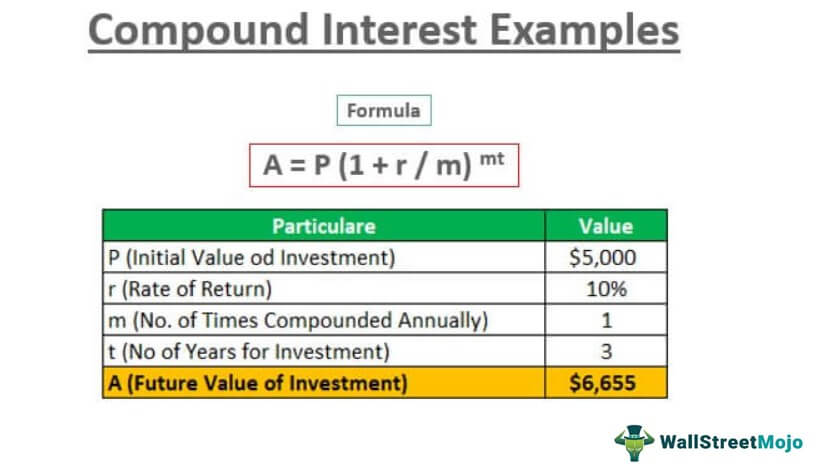

Compound Interest Examples Annually Monthly Quarterly

Fv Formula With Different Compounding Periods E G 100 At A 12 Nominal Rate With Semiannual Compounding For 5 Years

Mathematics Of Compounding Accountingcoach

Mathematics Of Compounding Accountingcoach

Quarterly Compound Interest Formula Learn Formula For Quarterly Compound Interest

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Compound Interest Formulas Derivation Solved Examples

Compounding Semi Annually Quarterly And Monthly Youtube

Future Value With Interest Compounded Semiannually Youtube

Compound Interest Ci Formulas Calculator

Compound Interest Definition Formulas And Solved Examples

Compound Interest Definition Formulas And Solved Examples